1% Risk Rule

There is a saying in the trading circle: The first rule to evaluate whether a trader is professional is not his profit level, but his risk control ability.

For professional investors, they don't care too much about the temporary rise and fall of a certain asset, but focus on portfolio management. The most important thing about portfolio management is not only to make the net value rise, but also to try not to let the net value fall when it is unfavorable. **

**Risk control has always been regarded as one of the compulsory courses for professional traders, and many famous traders have always regarded risk control as an important indicator in trading decisions. One of the risk management rules called ** "1% risk rule" is even more sought after by many traders.

**What is the 1% risk rule? **

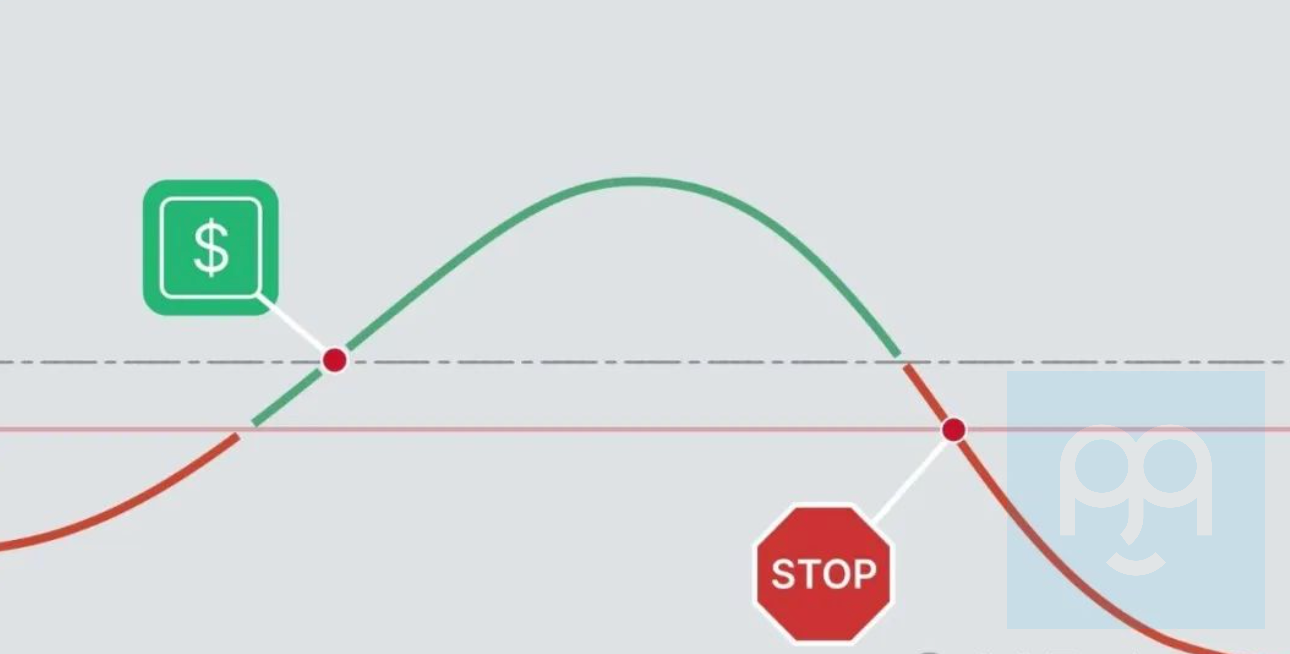

"1% risk rule"** means** that the risk of a single transaction shall not exceed 1% of the total account funds. This does not mean that only 1% of the funds are invested in a transaction. You can invest as much money as you want, but if the transaction loss exceeds 1% of the total account funds, you must close the position. **Most professional traders follow the risk standard of 1% or less. **

**For day traders and swing traders, the 1% risk rule means that you can start trading with whatever money you want, but your stop loss setting protects you from losing more than 1% of your account if a trade goes against you. It's up to you to use a stop loss, but the 1% risk rule means that you won't lose more than 1% of your account on a single trade. **

**If you allow yourself to risk 2%, then that's the 2% rule. If you only risk 0.5%, then that's the 0.5% rule. Regardless of the specific percentage you choose, the concept is the same: control your risk and keep losses on a single trade to a small portion of your account. **

**Why use the 1% risk rule? **

**Losing trades are inevitable, and even one losing trade can wipe out your account if you don't control them. The 1% risk rule prevents losses from getting out of control. It takes a number of losing trades in a row to have a significant impact on your account if you follow this rule. **

**It's still possible to make high returns even if you control your risk and keep it to 1% on every trade. So following this rule won't cost you money. In fact, controlling losses and keeping them small is necessary if you want to achieve consistently good returns. **

**Another key is to develop a favorable risk-reward strategy where your winning trades are larger than your losing trades. You risk 1% per trade, but your winning trades add 3%, 5%, or 10% to your account. **

Examples of the 1% Risk Rule in Action

**Take 1% of your account equity. This is the amount you can lose on a single trade. **

**As your account equity changes, so does the amount you can risk. **

**For Day Trading, I use 1% of my account starting capital each day, which is what I risk on each trade throughout the day. This way, I don't have to recalculate each time I day trade. The next day, the risk per trade may be slightly different. **

**For Swing Trading, use 1% of your current account equity. **

**Assume you have $10,560 in your account equity. The process is the same whether you are trading stocks, forex, or futures. **

**1. 1% of your account is $105.60 (0.01 x 10,560). Of course, you can round this up to $105 or $106. This is the amount you can lose per trade. We call this amount your account risk. **

**2. Next, you need to determine how much money you want to put into the trade based on your account risk and your stop size. The stop size is the difference between your entry price and your stop price. **

**Let's say you buy a stock at $125.35 and set your stop at $119.90. The stop size is $5.45. This means that if your stop is triggered, you will lose $5.45 per share. **

**3. You can lose $105.60, so divide it by $5.45. **

**Account Risk ($) / Stop Size = 105.60 / 5.45 = 19.37 shares, or 19 shares. **

**19 shares will cost: 19 x 125.35 = $2,381.65… that’s well over 1% of your account (about 1/4 of your account in this case), but you’re only risking 1% of your account on this trade. **

**Work backwards to make sure you have the correct position size and that you’re only risking 1%. **

**If you buy 19 shares and lose $5.45 per share, you’ll lose $103.55. With $10,560 in your account, you can afford to lose 1%, or $105.60. Therefore, your potential loss on this trade is within your 1% risk rule. **

**Forex and futures work the same way, except you also have to know the value of a pip in forex or a tick in futures. **

**By the way, no matter what my stop loss is, I will only trade if the expected profit is at least 2.5 times the risk. For example, if my stop loss is $1, I will only trade if the take profit price will reach a target of $2.50 or more above the entry price. **

**For intraday trading, I use 2 to 2.5 times, and for swing trading, I usually look for returns of more than 3 times. **

Practical application of the 1% risk rule

**Donald Darwin, an overseas trader, is a resolute implementer and beneficiary of the 1% risk rule. He joined Wall Street at the age of 26 and achieved an enviable performance of more than $2 million in profits in his first three years as a trader. **

**In the early days of trading, Donald was also very confused. He lost hundreds of thousands of dollars in just six months of trading. This made him very upset and confused. Later, Donald calmed down and sorted out his six-month trading. Finally, he found that the important reason for the loss was not because of improper strategy, but because he ignored the necessity of risk control. **

Donald says: If new traders follow the 1% risk rule**, many of them will start to make real money after a year of trading. Of course, when taking a 1% risk, you should also set a profit target of 1.5% - 2% on each trade. After a few days of trading, even if your trade success rate is 50%, you can still make a few pips.

**Assuming you have $30,000 in your account, using the 1% risk rule, you can afford to lose $300 on a single trade. This will allow you to know exactly where to stop loss. For example, if you buy a position worth $3000 in the EUR/USD currency pair at 1.0000 and use a leverage of 10x, your stop loss should be set at 0.9900. **

**This method allows you to adjust to various market conditions and make money regardless of whether the market is stable or not. This method also works in all markets. **

Adjusting the risk ratio

**Traders with trading accounts below $100,000 often use the 1% rule. After continuous profits, some traders will increase this risk ratio, such as increasing it to 2%. For accounts with more than $100,000, Donald Darwin recommends further reducing the risk ratio, such as to 0.5% or even 0.1%. Because the value of the position is too large, it has essentially increased the risk of the transaction. **

**For short-term trading, increasing the position by 1% risk will make the entire position too exposed. Every trader can find a percentage that makes them feel comfortable and in line with the liquidity of their trading market. But no matter what percentage you choose, it should be kept below 2%, Donald Darwin emphasized. **

Long-term profit, the last laugh

Following the 1% risk rule** may not get a good return for a period of time. But in the longer term, you will find that your account funds appreciate faster than others. Because you have accumulated more trading experience and practiced your own strategies within a smaller loss ratio range. **

In the trading market, risk control is the key to successful trading. The 1% risk rule** not only helps traders minimize losses when they lose, but also lays a solid foundation for long-term profits. No matter how volatile the market is, following the 1% risk rule and operating steadily will lead to the last laugh in the world of trading. **

Exceptions to the 1% Risk Rule

**It is difficult to follow the 1% risk rule when trading in illiquid markets. For example, if you are trying to trade $10,000 worth of crude oil futures contracts and the spot price remains at $50 per barrel for 10 consecutive days without any buying or selling activity, it will take more than 1%. Therefore, orders below 10% may not work due to low liquidity. **

FAQ:

**What is the formula for the 1% risk rule? **

**1. Calculate the account risk in USD, which is 1% of the account equity. **

**2. Calculate the stop size for a given trade, which is the difference between the entry price and the stop order price. **

3. Calculate the position size: Account Risk ($) / Stop Size = Position Size (Shares/Lots)

**4. To check your calculation, multiply your position size by the stop size. This number should be equal to or less than 1% of your account equity. **

**What is the maximum you should risk per trade? **

**When day trading or swing trading, risk no more than 1% of your account. Risk a maximum of 2%. Most professionals risk 1% or less. **

**What is the 2% risk rule? **

**According to this rule, a trader should not lose more than 2% of their account equity on a single trade. For example, for a $10,000 account, exit a trade at or before a loss of $200 (0.02 x $10,000). **

**Can you risk 5% per trade? **

**Usually only traders with smaller accounts or inexperienced ones are willing to risk 5% per trade. The cost of inexperience or capital can be high, as even a few consecutive losing trades can quickly deplete an account. When you are first starting out, it is best to risk 0.5% or even 0.25% per trade. Once you see consistent profits over a few months, you can increase your risk to 1% per trade. Risking 1% can yield a lot of profit potential. There is no reason to risk 5% on every trade. **

All comments